The worries surrounding the French election results saw EUR/USD open with a gap lower at 1.0800 earlier today. But the pair is keeping its upside bias, with buyers staving off a test of the figure level and the key daily moving averages at 1.0794-97. That allowed for a modest bounce with the pair now hovering around 1.0830 levels on the day.

Besides that, we’re also getting a decent bounce in USD/JPY in the last few hours. The pair was dragged down to a low of 160.26 in Asia trading but is trading back up to 160.91 currently. That said, price action is still keeping below its 200-hour moving average of 161.02. As such, sellers are still in near-term control.

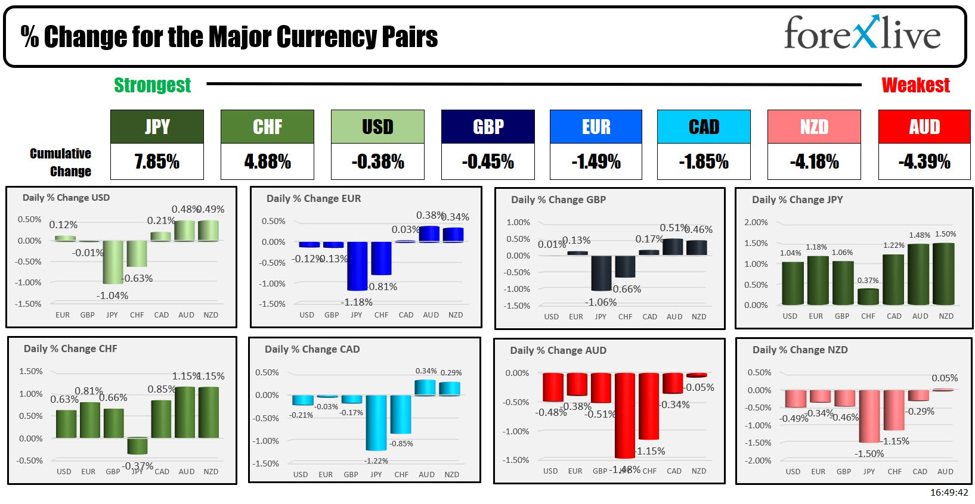

Elsewhere, the changes are relatively light among dollar pairs. GBP/USD is flat at 1.2810 and AUD/USD down marginally by 0.1% to 0.6740 on the day.

So, what’s next for the dollar?

There might not really be much to work with until we get to the US CPI report on Thursday to be honest. Going into the jobs report on Friday, markets were more or less pricing in two rate cuts already with the odds of a September move seen around ~80%. The former hasn’t changed much with traders seeing 49 bps worth of rate cuts by year-end. Meanwhile, the latter is still seen at ~80% currently as well.

Still, it did trigger some technical movements in the dollar with GBP/USD on the verge of touching its June high of 1.2860 and AUD/USD up to its highest since January above 0.6750.

A chunk of that is triggered by the drop in Treasury yields though perhaps. 10-year yields are down to 4.305%, way off the high last week of 4.493%.

Essentially, it just spells out as saying that the dollar is in a softer spot but not exactly down for the count. At this point, I would still argue that the threshold for traders to move to price in three rate cuts is way, way taller than having to price in one rate cut; depending on the data.

It will take quite compelling data in the weeks ahead to change the market view as such. Otherwise, we might just be stuck at continuing to price in two rate cuts by the Fed for this year. If so, that’s pretty much a floor that the dollar can rest on.

This article was written by Justin Low at www.forexlive.com.

Source link