Via a note from Deutsche Bank saying negative momentum is not easing.

- S&P 500 has managed to rise for 23 of the last 30 weeks, DB says this is a joint record since 1989

The ‘however’ is that the broad market pullback on Wednesday and Thursday suggests momentum is now more negative

- rise in longer-dated yields proved bad news for global risk assets

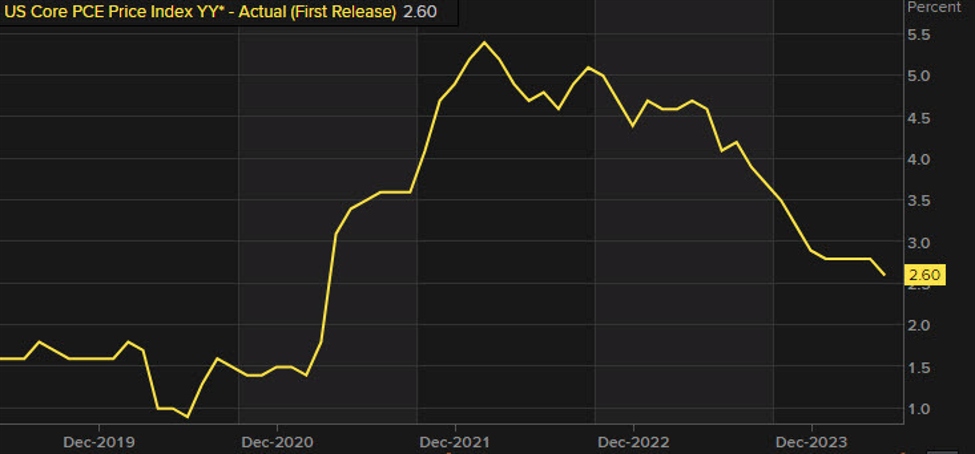

- Bonds took a particular hit after a weak US Treasury auction yesterday, along with mounting concern about inflationary pressures

- a tough backdrop for markets across several asset classes

- the relentless run of gains in recent weeks was always going to be tough to maintain

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link