The Michigan survey numbers were much weaker than expectations. Despite the sharp declines, the dollar is steady and trading near highs vs the EUR and GBP.

The Michigan survey may be losing some of its bite as politics takes control going into the election. If you are Trump supporter, the situation is dire. If you are a Biden supporter, the situation is just fine.

Nevertheless, the EURUSD is trading just off its low level at 1.06668 (dollar remains near high). The price currently trades at 1.0673.

The GBPUSD is now trading below its 200 bar moving average on the 4-hour chart at 1.2668 increasing the bearish bias technically. The price is currently trading at 1.2666. The 38.2% retracement of the move-up from the April low comes at 1.26455 and is the next downside target on more selling. The 100 day moving average is at 1.26387.

On the topside, get back above the 200-bar moving average on the 4- hour chart and the swing area floor between 1.2675 and 1.2685 gives the dip buyers some hope that the low is in place.

The USD remains near highs vs the NZD, AUD, CAD.

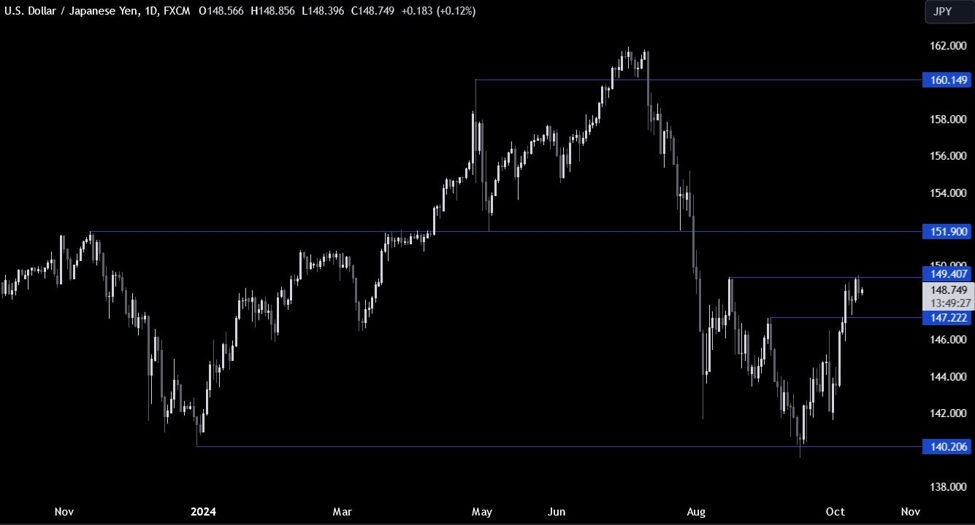

Conversely, the USD is near(er) its lows vs the JPY and the CHF as flow of funds is into those two currencies. The BOJ delayed bond selling to July (maybe….punt). The USDJPY initially moved higher after the decision (lower JPY), but has since retraced the entire move higher io the pair.

This article was written by Greg Michalowski at www.forexlive.com.

Source link