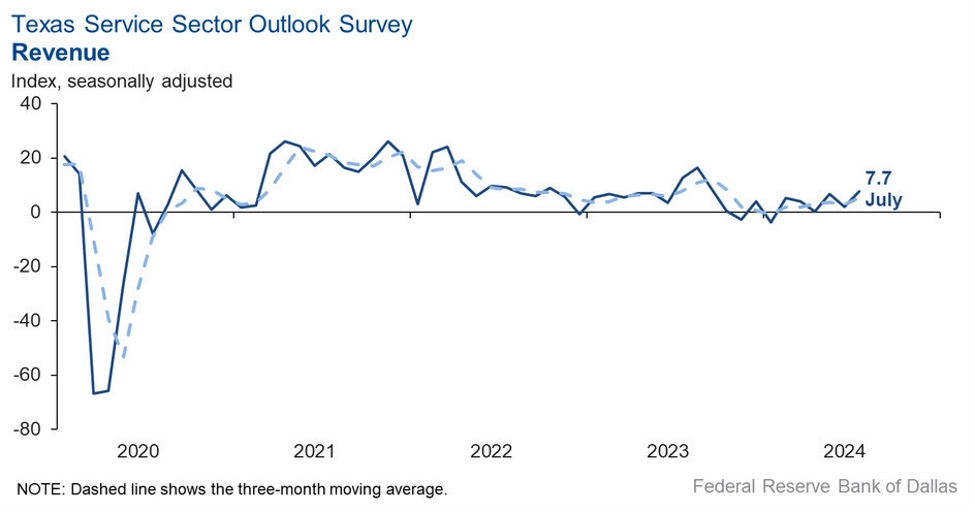

- Prior was +1.9

- Service sector outlook -0.1 vs -4.1 prior

- The employment index -0.2 vs +1.8 prior

- The input price index fell from 24.7 to 21.8 and the wages and benefits index moved down from 16.4 to 13.4

- Retail sales outlook -18.1 vs -18.1 prior

Comments in the report:

Utilities

- It feels like the economy is getting better.

Pipeline transportation

- We expect Permian Basin oil demand to grow 200 million to 300

million barrels per day across 2024. More volume drives our

expectations for revenue growth.

Support activities for transportation

- Bad local cotton crop expected due to bad weather.

- Our industry has seen an increase in activity and a hairline increase in selling prices.

Warehousing and storage

- We think some good news on the inflation front provides hope for

a soft landing and maybe even a potential rate cut that could spur

additional business.

Publishing industries (except internet)

- New advanced, customer-built, do-it-yourself lessons via

software capabilities have been offered for mixed reality training with

AI assisted metrics. More training opportunities are emerging within the

Department of Defense, showing interest in the development of apps. New

and more advanced software and licensing are the main reasons for a

better outlook, not current economic conditions. - There is still a high amount of uncertainty about rate cuts and,

subsequently, cost of capital. Simultaneously, we are wary that

consumer spending will not hold up over the next six month unless

something changes or there is more liquidity in the system. The election

and the impact that will have on economic policy and rates are also

adding to the uncertainty and ambiguity. We are hesitant to

forward-invest until the Federal Reserve behavior and economic data

suggest the economy has achieved some sort of soft landing.

Credit intermediation and related activities

- The political climate has intensified the feeling of

uncertainty, especially after the assassination attempt on former

President Trump. Economically, the rural markets are fairly steady but

not robust. The most prevalent inflationary pressure across the board is

the increase in insurance premiums including health insurance for

employee coverage. Auto, homeowners’ coverage and liability insurance

premiums have been substantial. We are beginning to hear of lower income

families dropping or not renewing coverage of their homes. The interest

rate on residential real estate, combined with escrow for insurance and

taxes, is increasing debt service coverage for anyone financing a home.

Insurance carriers and related activities

- Business is stable. Insurance increases are moderating somewhat. All eyes are on the November election currently.

Real estate

- The presidential election causes uncertainty. House inventory remains low.

- Interest rates in the form of mortgage rates are the question mark. Lower rates are good for our business.

Rental and leasing services

- We finished 1Q 2024 down 2 percent compared to 1Q 2023. The

second quarter was even slower, ending down 9.6 percent. We averaged

over 10 percent growth in revenue per year for over 65 years, so that

makes us think these quarterly reports are more than just an anomaly. We

think the Federal Reserve has finally gotten this economy pulled back;

whether they have killed it or not is yet to be seen.

Professional, scientific and technical services

- This is the worst month we have had since the Great Recession.

It was even worse than the first month of the pandemic. There are almost

no new starts on multi-family or self-storage, and building permits are

well down. We have seen increased activity in new prospects, leads, as

well as deals. We suspect this is due to a combination of sales and

marketing efforts, as well as the slight easing in inflation, which has,

in turn, likely improved business and consumer confidence. - The pace of business activity has slowed down. Operating cost

has increased, including the cost of software subscriptions and facility

maintenance. Also, there’s been a loss in productivity due to hurricane

preparation and summertime vacation. There is a general sense of a loss

of momentum and uncertainty. - Changes in the presidential race have created significant added

uncertainty as to the future regulatory climate in the energy sector. - The real estate market has been stagnated for the past year and a

half and will remain so until interest rates stabilize. We are hoping

this is the bottom, but until regional banks find a way to begin making

loans, the real estate market will not recover. We are at a breaking

point if the banks start taking property back and cannot find a way to

make loans. - We are a recruiting company. Our retained search side has been a

little busier this month than last month, and we hope to have even more

work in August and for the second half of the year. Our outsource

recruiting side has been the same this month versus last month, but we

hope it will grow.

Administrative and support services

- The bottom has fallen out of the professional-level hiring

market. Clients are not hiring or are very slow to make decisions. The

cost of money for our clients (and for us) is preventing us from hiring

and optimizing production in our businesses. We are living on the edge

of recession and truly need the Federal Reserve to take action and start

to lower rates. Layoffs are imminent. - There is still pressure on wages and the ability to hire employees at line-level blue collar work.

- We are concerned about interest rates, but economic activity seems strong.

Ambulatory health care services

- We were dramatically affected by Hurricane Beryl and the power

outages this month. Then we were affected by the Crowdstrike update

issue as well. We lost significant business due to these factors in

July.

Texas Retail Outlook Survey

Amusement, gambling and recreation industries

- Weather has been the real negative factor for our business.

Accommodation

- Hurricane Beryl caused a drastic change in our business,

increasing our occupancy and revenue dramatically over the previous

month and same time last year. We also experienced some damage that

caused us to have some capital expenses, but minimal for the most part. - In our market, we manage three hotels, one downtown and two on

the northside of our city. The two on the northside are performing as

expected. Downtown demand has been sluggish. Factors that are

contributing to this issue include a lack of group business and

construction throughout our downtown area. For the first time in a

while, we have had a restaurant on the riverwalk close due to the lack

of demand. Based on our advance bookings, this will continue to play out

until we get into fall.

Merchant wholesalers, durable goods

- We are seeing a softening in sales to the construction market.

Merchant wholesalers, nondurable goods

- The best words to describe retail are stagnant or grinding day to day.

Motor vehicle and parts dealers

- We have a challenging business model. We are seeing margin

compression. Inventories are abnormally high and the cost-to-carry is

severely impacting profitability. Affordability is a major issue and

ongoing concern. - Demand for new and used vehicles continues to be strong. Inventory growth has slowed down and is starting to plateau.

Electronics and appliance stores

- Retail is struggling.

Building material and garden equipment and supplies dealers

- The lumber market is weak, and sales seem to be flat from month to month, with no real signs of improving.

- There is very little activity. The combination of steel prices

decreasing and the promise of lower interest rates sometime in the

future is causing everyone to delay.

This article was written by Adam Button at www.forexlive.com.

Source link