The Canadian dollar is underperforming today and at first the move is puzzling but at second looks shows why it makes sense.

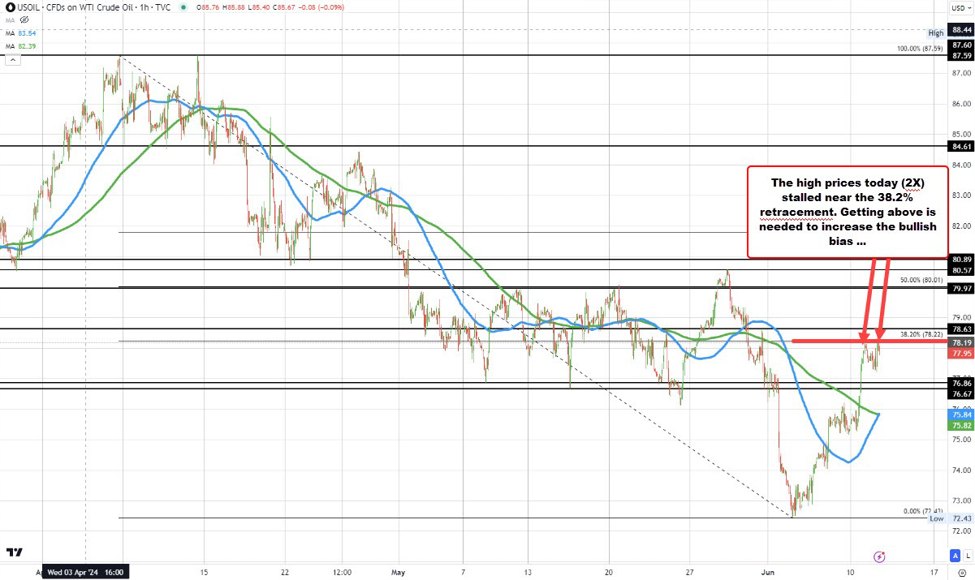

The loonie is up 0.5% today and that’s a good gain but it’s far short of the +1.2% for the Australian and New Zealand dollars. The loonie is also underperforming the pound, yen and euro. That’s despite a strong day for equities with the S&P 500 up 1.2% to a record high and oil up $1.33 to $79.22.

Why is the loonie sluggish?

I believe this is about the Bank of Canada. Last week we saw the BOC (and ECB) remain cautious about further rate cuts. I believe that’s about to fade away. Central banks don’t like to detach too far from the Federal Reserve and if the Fed is dovish today and signals two cuts, it will lead to a more-dovish stance from the BOC.

In short, the Fed will give the BOC permission to signal a rate-cutting cycle. I think that’s appropriate given the fresh cracks in Canadian housing. The strong start in the spring market faded quickly and inventories continue to rise. The BOC cut may have also been more of a signal for sellers to list than for buyers (who can’t qualify for mortgages anyway) to buy.

Backing out, the US dollar softness today shows USD/CAD consolidating.

I think that’s the right way to look at it now as we wait for either the US or Canadian economy to stumble or nail the soft landing.

This article was written by Adam Button at www.forexlive.com.

Source link