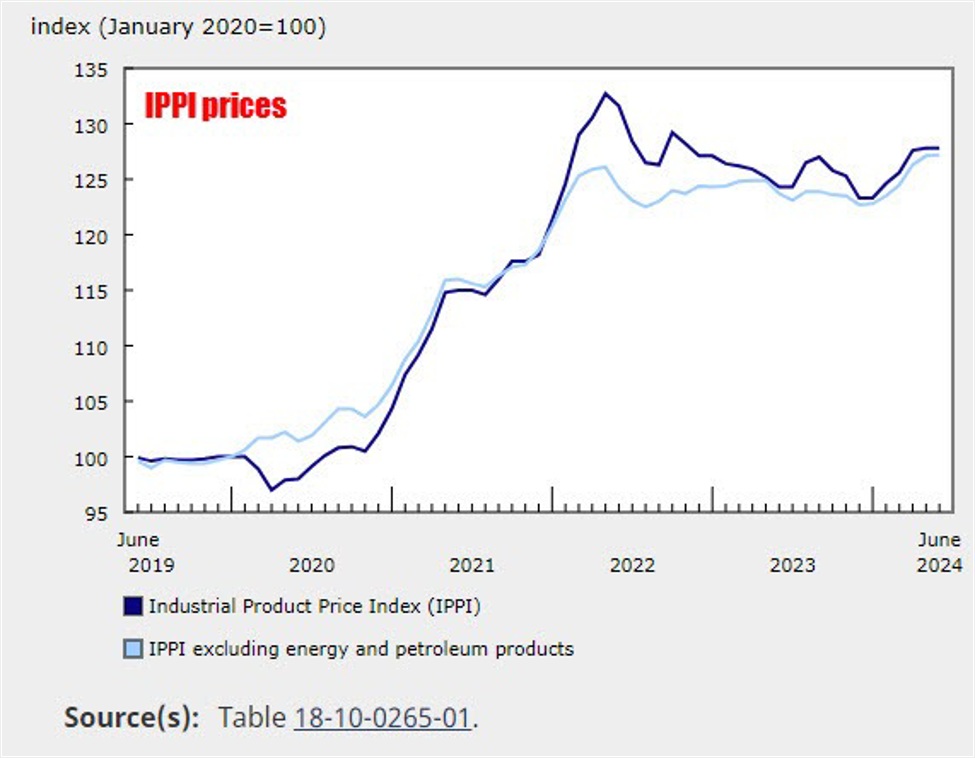

- Prior IPPI prices 0.0% revised to 0.2%

- IPPI prices 0.0% versus 0.2% expected

- IPPI prices YoY 2.8%

- Raw material price index -1.4% versus -0.7% expected. Prior month -1.5%

- RMPI YoY +7.5% for the 4th consecutive year-over-year increase. Base executed the level year-over-year increase as the RMPI fell -5.4% in May. THe June 2023 number showed at -2.0% decline which dropped out of the YoY increase this year. The price of metal ores, concentrate and scrap fell -5.5% were the mystery to be June 2003 decrease, while the prices of crude energy dropped-9.8% in May 2023

Details of IPPI prices:

- Prices for meat, fish, and dairy products: +2.4%. That was the largest contributor. 4th straight increase

- Fresh and frozen beef and veal: +5.6%

- Fresh and frozen pork: +4.6%

- Prices for pulp and paper products: +1.7%

- Wood pulp: +2.9%

- Prices for primary non-ferrous metal products: -0.4%

- Unwrought nickel and nickel alloys: -10.3%

- Unwrought copper and copper alloys: -4.5%

- Prices for energy and petroleum products: -0.4%

- Finished motor gasoline: -3.5%

- Diesel: +3.3%

Details of the raw material price index:

-

Crude energy products: -1.2%

- Synthetic crude oil: -3.1%

- Conventional crude oil: -0.1%

- Key details: Decline driven by OPEC+ announcement on phasing out production cuts, later price rebound due to geopolitical tensions.

-

Metal ores, concentrates, and scrap: -1.7%

- Nickel ores and concentrates: -10.4%

- Iron ores and concentrates: -9.4%

- Copper ores and concentrates: -7.1%

- Key details: Price declines influenced by Chinese market dynamics, rising stockpiles at Chinese ports, and soft demand for steel in China.

-

Crop products: -1.9%

- Canola: -5.6%

- Wheat: -3.5%

- Key details: Improved North American canola production expectations and pressure to sell harvested wheat in overseas markets.

This article was written by Greg Michalowski at www.forexlive.com.

Source link