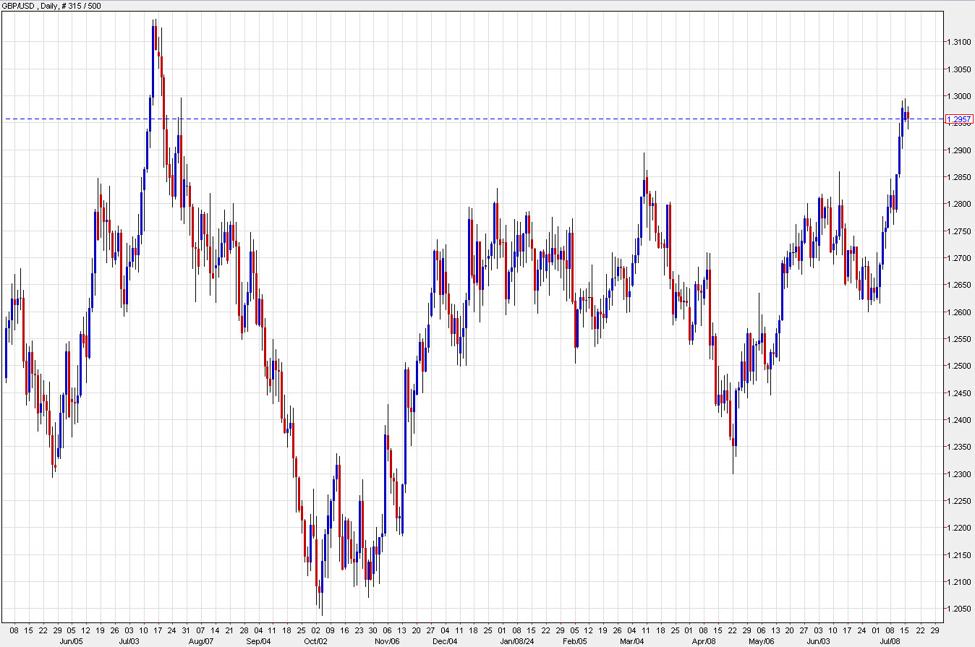

Bank of America observes that GBP/USD is starting to break its secular downtrend, which has been in place since 2008. Recent technical signals suggest a potential rally towards 1.40, contingent on a sustained break above key resistance levels and the 200-week SMA.

Key Points:

- Secular Downtrend: GBP/USD has been in a secular downtrend since 2008, attempting to break higher three times in the last 18 months but failing.

- Technical Resistance: Previous bearish bias was suggested while GBP/USD remained below resistances in the 1.2850-1.29 area, targeting declines to 1.2450 and potentially 1.21.

- Impulsive Move: An impulsive move through these resistance levels could signal the end of the secular decline and a rally toward 1.40.

- Current Breakout: As of the week ending July 12, GBP/USD is starting to break above resistance lines and the 200-week SMA at 1.2849, turning the outlook from pessimistic to optimistic.

- Confirmation Needed: A few weekly closes above the 200-week SMA would further confirm the trend change to an upward trajectory, supporting the (ABCDE) labeling as the end of a falling wedge pattern.

- Positioning Risk: A significant risk is the current positioning, with net long GBP futures divided by open interest at its highest level since 2011, indicating potential overextension.

Conclusion:

BofA notes a potential technical shift in GBP/USD as it starts to break its long-term downtrend. A sustained move above key resistance levels and the 200-week SMA could signal a rally towards 1.40. However, the high level of net long GBP futures poses a risk, suggesting caution in the face of potential overextension.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here

This article was written by Adam Button at www.forexlive.com.

Source link