Bank of America highlights that recent US growth indicators have started to turn lower, and inflation appears to be easing. This trend has tempered the USD’s strength, as markets anticipate a potential Fed easing cycle this year. BofA’s G10 FX HeatMap provides a broader context for the USD outlook by evaluating multiple metrics across G10 currencies.

Key Points:

- US Growth and Inflation: Indicators show US growth slowing and inflation easing, contributing to the USD pulling back from near-year-to-date highs.

- Fed Easing Expectations: The recent data supports the plausibility of a Fed easing cycle starting this year, influencing the USD outlook.

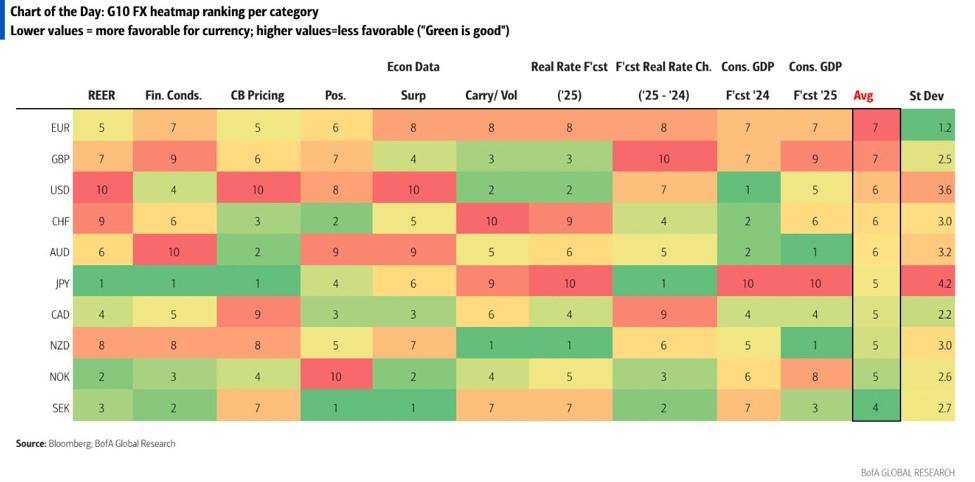

- G10 FX HeatMap: BofA’s heatmap evaluates G10 currencies on metrics such as growth and inflation outlooks, interest rates, valuation, financial conditions, positioning, and economic data trends.

- Key Observations:

- Scandinavian Currencies: Favorable outlooks based on the evaluated metrics.

- USD and JPY: A wide distribution of favorable and unfavorable scores, indicating mixed outlooks.

- EUR: Across-the-board sub-average scores, suggesting a less favorable outlook.

Conclusion:

BofA’s analysis indicates a mixed outlook for the USD, influenced by slowing US growth and easing inflation, which support expectations of a Fed easing cycle. The G10 FX HeatMap reveals favorable prospects for Scandinavian currencies and mixed signals for the USD and JPY, while the EUR shows generally unfavorable metrics. This comprehensive evaluation helps contextualize the potential movements in G10 currencies going forward.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

This article was written by Adam Button at www.forexlive.com.

Source link