Judo Bank S&P Global Manufacturing PMI final April 2024 from Australia comes in at 49.6

- the preliminary reading was 49.9, prior was 47.3

Manufacturing nearly jumped into expansion at a 3-month high, but not quite hitting the 50 line.

Warren Hogan, Chief Economic Advisor at Judo Bank, in brief:

- Manufacturing activity improved sharply in April

- output and new orders were both higher in the month

- too early to call an end to the cyclical slowdown

experienced by Australia’s manufacturing sector over the

past 12 months - manufacturing sector price indicators have

mostly normalised back to pre-pandemic levels over the

past six months. The jump in April is relatively small, with

manufacturing input and output prices still below the

readings from the services sector. - The jump in the input price index in April suggests that cost

pressures are rising, likely due to a combination of higher

raw materials prices and the effects of a weaker Australian

dollar. Labour costs are still on an upward trajectory due to

tight labour markets and skills shortages. - The

employment index improved throughout April, increasing

to 49.9 which, while below the neutral level, is the highest

reading in six months. If activity indicators continue to

improve over the months ahead, we expect this will quickly

translate into increased labour demand.

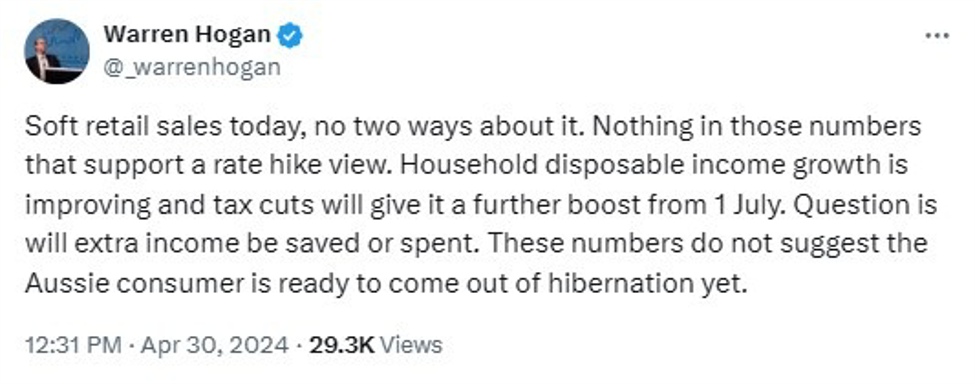

Hogan is a well-respected Australian economist, for good reason, and has been on the ball re sticky inflation for a l;ont time. He tweeted on the soft retail sales data yesterday too, dismissing the idea of a rate hike from the RBA:’

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link