After the softer US PMI data yesterday, it is keeping the Fed outlook more interesting. The dollar fell as traders might have to consider at least one rate cut for the year. But in the case of the aussie, it doesn’t seem like rate cuts might be on the table for this year. That especially as inflation data remains rather sticky as seen here.

The trimmed mean reading is the most pivotal one and that is seen at 4.0%. Yes, it is down from 4.2% previously but still not enough to convince of a significant disinflation trend. At least not one that would compel the RBA to act any time soon.

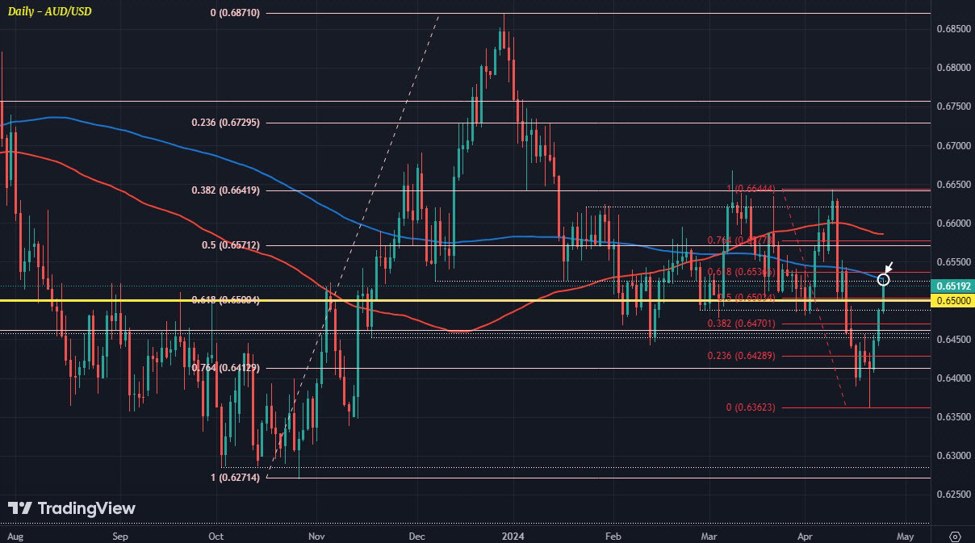

AUD/USD has seen a decent bounce today as such, with the pair touching a high of 0.6530 earlier. That sees it run into a test of its 200-day moving average (blue line):

And that is holding back gains for now, alongside the 61.8 Fib retracement level (red) at around 0.6536. After which, there is the 100-day moving average (red line) offering the next key resistance level but that is only seen at 0.6585 currently.

So, what’s next for the pair?

What was previously a divergence trade between the dollar and the rest of the major currencies bloc has now changed. That particular divergent factor has closed with the RBA also perhaps being one of the later – if not the latest – central banks to cut rates. And that’s a boon for the aussie, especially now as it coincides with a pick up in risk.

It will now come down to what the next set of US data has to offer, in particular the inflation numbers. And we won’t have to wait too long as there is the PCE price index due on Friday this week.

That might offer a key trigger point for traders to work with before the weekend comes along.

This article was written by Justin Low at www.forexlive.com.

Source link