Fundamental

Overview

The USD weakened across the

board following soft US Jobless Claims and ISM Services PMI reports. Overall, the data didn’t

change much in terms of interest rates expectations, but it reinforced the view

that the Fed is going to deliver at least two rate cuts by the end of the year.

The AUD, on the other hand,

has been under pressure mainly due to the US Dollar strength last week which

has been influenced more by quarter-end flows rather than something

fundamental. This week, the US Dollar is back on the defensive as the market

continues to trade the soft-landing narrative.

Moreover, the Australian

Dollar should be favoured in such environment as it’s also backed by a slightly

more hawkish RBA. Recently, the Aussie got a boost from another

hot monthly CPI report which raised the chances of

a rate hike, although RBA’s Hauser poured some cold water on the

expectations as he would rather hold rates steady for longer.

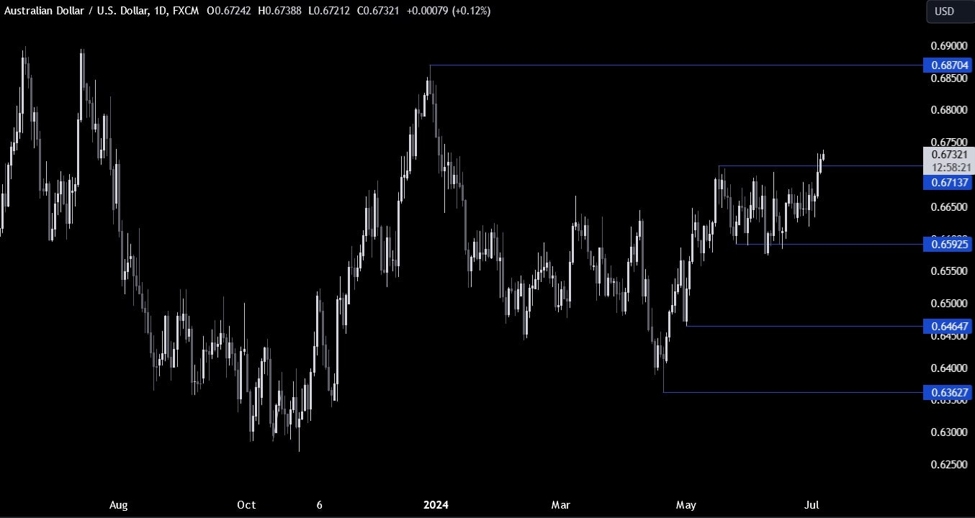

AUDUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that AUDUSD broke out of the two-month long range recently as the price

rallied above the key resistance around the 0.6713 level following

the soft US data on Wednesday.

We should see the buyers increasing

the bullish bets around this level to position for a rally into the 0.6870

level next. The sellers, on the other hand, will want to see the price falling

back inside the range to invalidate the breakout and position for a drop into

the 0.66 support.

AUDUSD Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see more clearly the breakouts of the recent mini range at 0.6680 and the major

one at 0.6713. The US NFP report today is going to be key. If we get bad data,

the market might go into risk-off and leave behind a fakeout as the pair will

likely fall back inside the range. A good or benign report, on the other hand,

should confirm the breakout and lead to a more sustained uptrend.

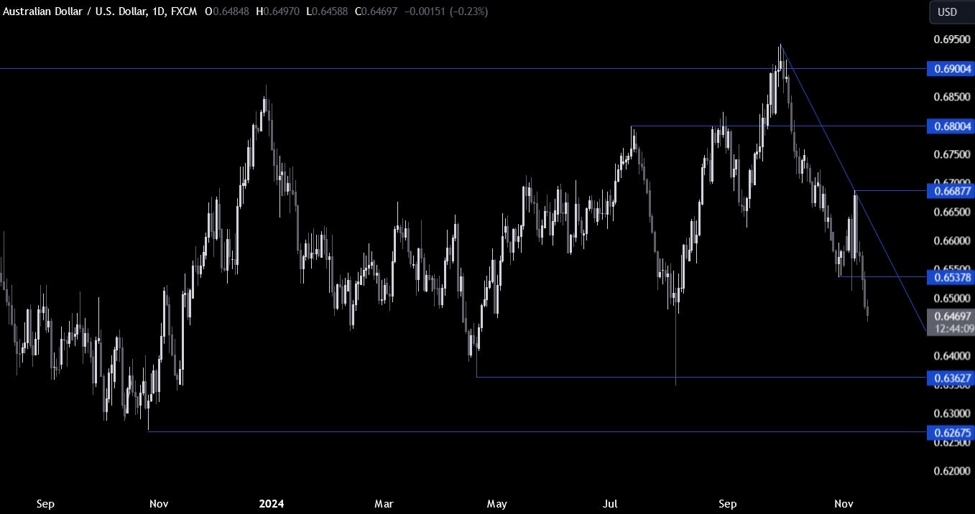

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we now have a good support around the 0.6700-0.6713 zone where we can

also find the 38.2% Fibonacci retracement level for confluence. If we get a

pullback, that’s where the buyers will likely step in to position for the continuation

of the uptrend.

The sellers, on the other

hand, will want to see the price breaking lower to position for a drop back

into the bottom of the range around the 0.66 level. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we conclude the week with the US NFP report where the data is expected

to show 190K jobs added in June and the Unemployment Rate to remain unchanged

at 4.0%.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link