Fundamental

Overview

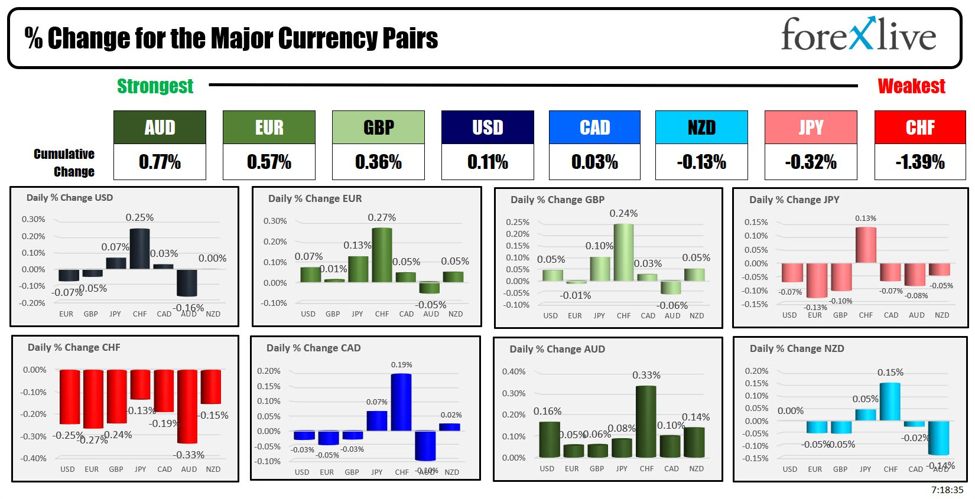

The USD came back with a

vengeance last Friday following the strong US NFP report where the data surprised with solid job

and wage growth. There were also negatives like the uptick in the unemployment

rate, but all in all, we can say that it was a good report.

The data triggered a

hawkish repricing in interest rates expectations with the market now expecting

once again just one cut by the end of the year. It’s not a big deal in the

bigger picture, but for now the sentiment is bullish for the greenback and we will

likely need a catalyst to change it again.

The AUD, on the other hand,

has been supported by a slightly more hawkish RBA and the positive risk

sentiment due to the pickup in global growth. Moreover, the pickup in China’s

economy is generally good news for the Aussie as well as it’s Australia’s

biggest trading partner. If we go back into risk-on sentiment, the greenback

could start to lose ground again.

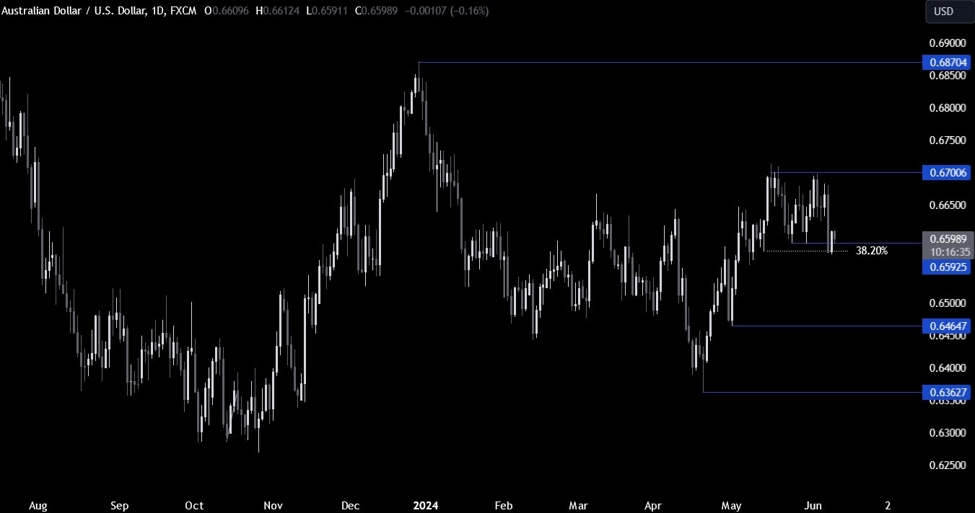

AUDUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that AUDUSD dropped back into the bottom of the recent range around the

0.66 handle where we can also find the 38.2% Fibonacci

retracement level of the entire rally since the end of April.

This is where we can expect

the buyers to step in with a defined risk below the support

to position for a rally into new highs with a better risk to reward setup. The

sellers, on the other hand, will want to see the price breaking lower to gain

even more conviction and target the 0.6464 level next.

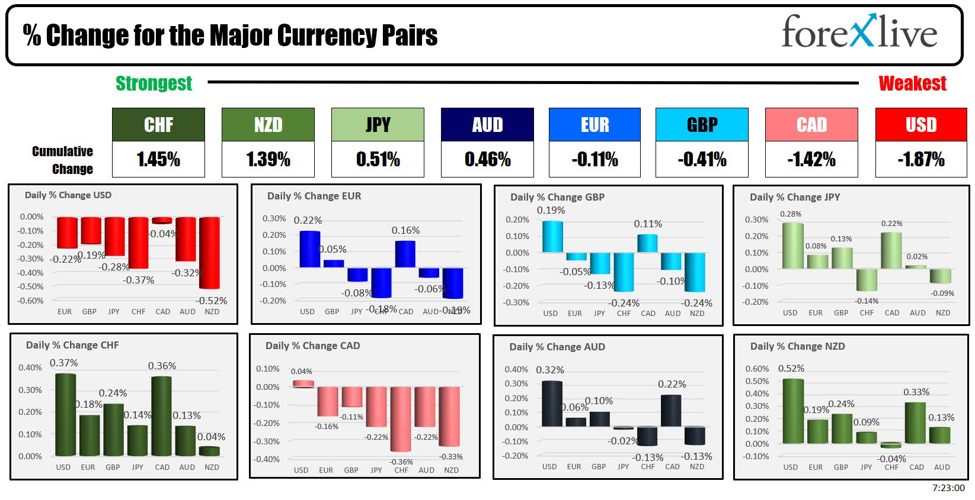

AUDUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see more clearly the rangebound price action between the 0.67 resistance and

the 0.66 support. The US CPI report tomorrow will likely decide where we are

going to go next as hot data should give the USD even more strength and send

the pair lower, while soft figures will likely weaken the greenback leading to

a rally in AUDUSD.

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that from a risk management perspective, the sellers will have a better

risk to reward setup around the 0.6630 resistance where they will also find the

38.2% Fibonacci retracement level of the recent drop.

The buyers, on the other

hand, will want to see the price breaking higher to gain even more conviction

and increase the bullish bets into new highs. The red lines define the average

daily range for today.

Upcoming

Catalysts

This week is a bit empty on the data front although we will

have the biggest market moving events tomorrow when we get the US CPI data and

the FOMC rate decision. On Thursday, we have the US PPI and the latest US

Jobless Claims figures. On Friday, we conclude the week with the University of

Michigan Consumer Sentiment survey.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link