Fundamental

Overview

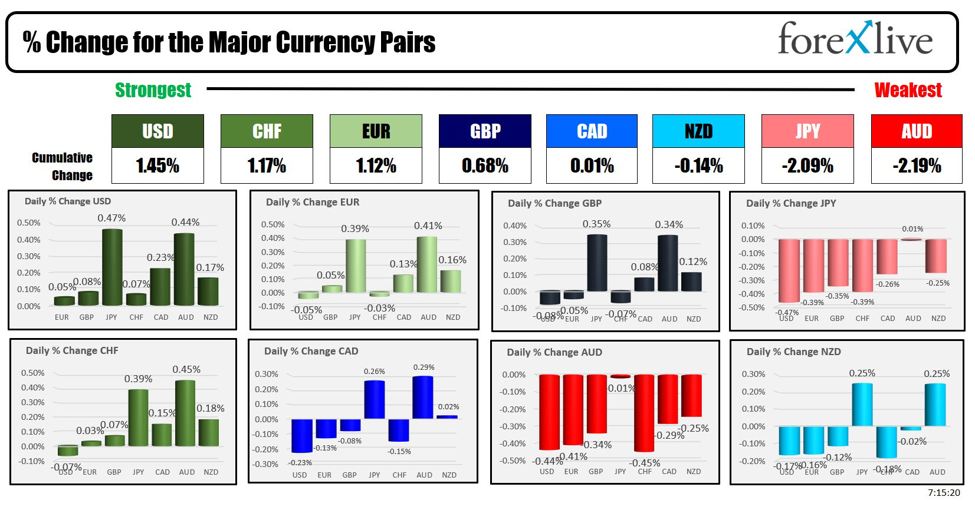

The USD rallied across the

board last Friday following the hot US NFP report. The market priced out all the

aggressive rate cuts expectations and it’s now finally in line with the Fed’s

projections.

This week, the greenback

extended the gains as the market started to price in some chances of a pause in

November. The focus remains on the economic data.

Today we get the US CPI

report. We will likely need a hot report to see some more downside in the pair,

while a miss could see the pair rising on the market paring back the hawkish

expectations.

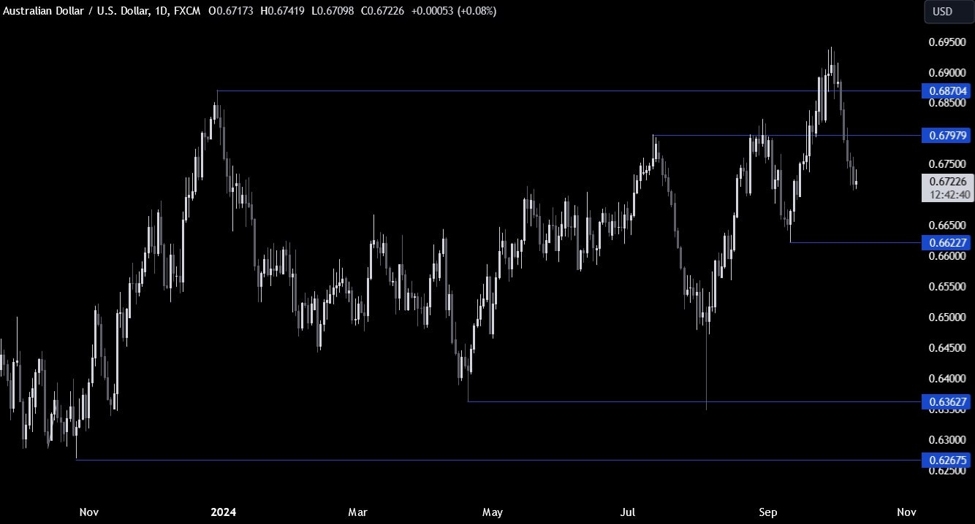

AUDUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that AUDUSD is trading right in the middle of two key levels. The target

for the sellers should be the 0.6622 level although they will likely need a hot

US CPI report today to see the bearish momentum increasing. The buyers, on the

other hand, will want to see the price bouncing back and breaking above the 0.68

handle to target new highs.

AUDUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have a downward trendline defining the current bearish

momentum. The sellers will likely keep on leaning on it to position for further

downside, while the buyers will want to see the price breaking higher to pile

in for a rally into new highs.

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see more clearly the recent price action with the trendline acting as a strong barrier.

There’s not much else to add here as the sellers will look for a rejection and

new lows ahead, while the buyers will want to see the price breaking higher to

gain more confidence for new highs. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US CPI report and the US Jobless Claims figures. Tomorrow,

we conclude with the US PPI and the University of Michigan Consumer Sentiment

report.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link