Fundamental

Overview

The US Dollar continues to

consolidate around the highs as the market reached the peak in the repricing of

interest rates expectations and it will need stronger reasons to price out the

remaining rate cuts for 2025.

This was signalled by the

lack of US Dollar strength after lots of strong US data with the market’s

pricing remaining largely unchanged around three rate cuts by the end of 2025.

We might see the greenback remaining on the backfoot at least until the US CPI

due next week.

Yesterday, Fed’s Waller and Fed’s Williams sounded like a rate cut in December

is basically a done deal with the plan to slow the pace of rate cuts

considerably in 2025. We will likely need another hot CPI report to force them

to skip the December cut.

On the AUD side, the market

expects just two rate cuts by the RBA next year with the first one fully priced

in for May 2025. The Australian economic data remains solid while inflation

continues to fall slowly keeping the central bank in a neutral stance.

AUDUSD

Technical Analysis – Daily Timeframe

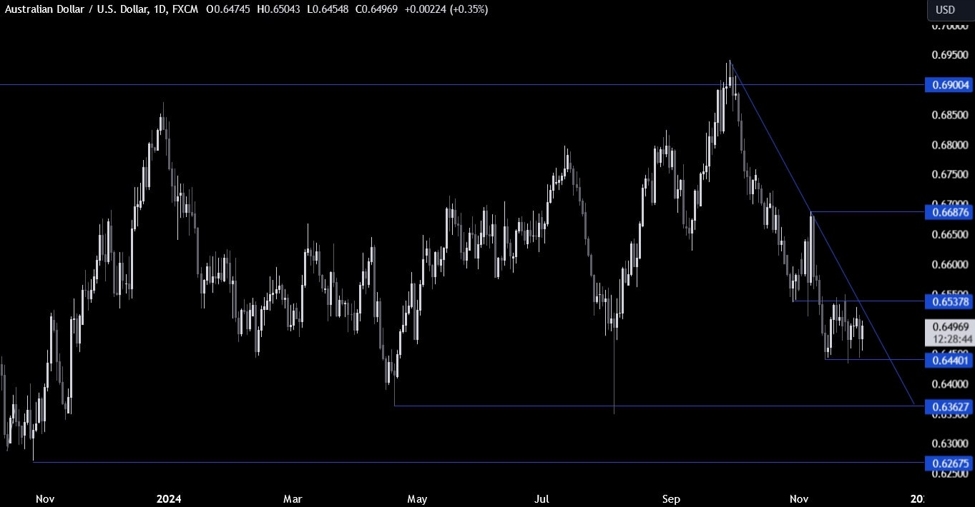

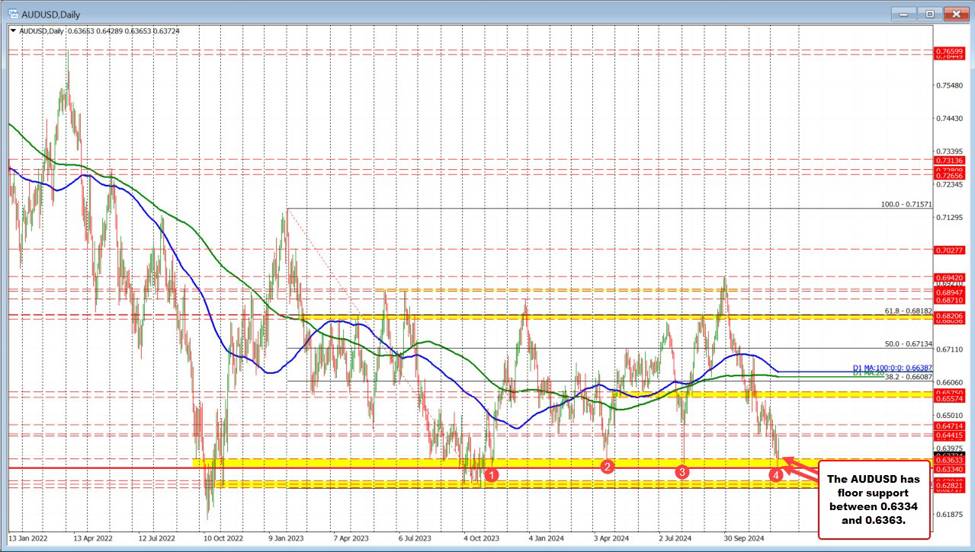

On the daily chart, we can

see that AUDUSD is stuck in a range between the 0.6440 support and the 0.6540 resistance. The market

participants will likely keep on playing the range until we get a breakout on

either side.

AUDUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have a very strong resistance zone around the 0.6540 level where we

can also find the major trendline for confluence.

That’s where we can expect

the sellers to step in with a defined risk above the resistance to position for

the continuation of the downtrend. The buyers, on the other hand, will want to

see the price breaking higher to invalidate the bearish setup and position for

a rally into the next resistance at 0.6687.

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a minor upward trendline defining the current pullback into

the resistance. The buyers will likely lean on it to keep pushing higher, while

the sellers will look for a break lower to target a break below the support. The

red lines define the average daily range for today.

Upcoming

Catalysts

Today,

we get the US Job Openings data. Tomorrow, we have the US ADP, the US ISM

Services PMI and Fed Chair Powell speaking. On Thursday, we get the latest US

Jobless Claims figures. Finally, on Friday, we conclude the week with the US

NFP report.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link