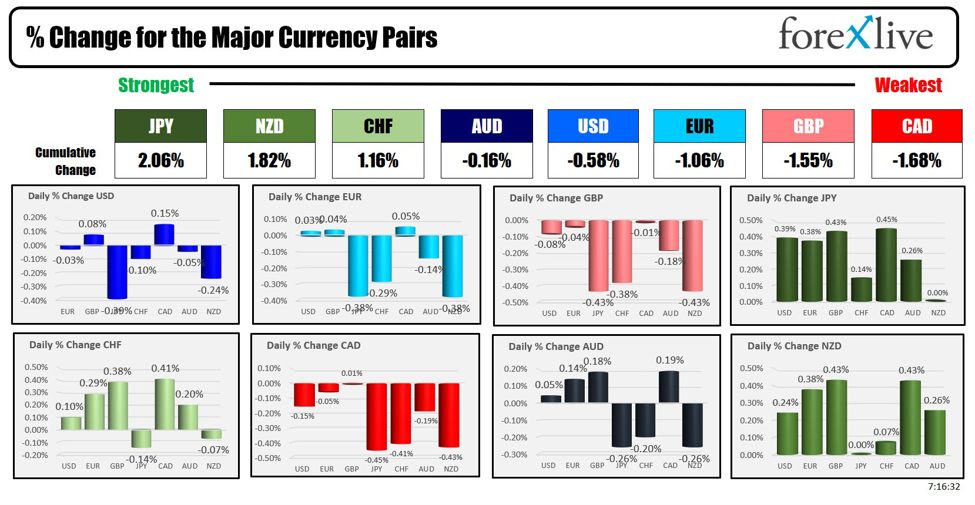

Fundamental

Overview

The US CPI yesterday came in line with expectations

leading to a bit of a “sell the fact” reaction in the US Dollar.

The bullish momentum picked

up a bit later though as Fed’s Logan delivered a hawkish comment saying that “models show that Fed funds could

be very close to neutral” basically implying a lot more cautious approach on

rate cuts in 2025.

The market is viewing all

of this in light of the recent US election as Trump’s policies are likely to

spur growth and potentially keep inflation above target for longer, making the

Fed’s job of bringing inflation back to target a bit harder.

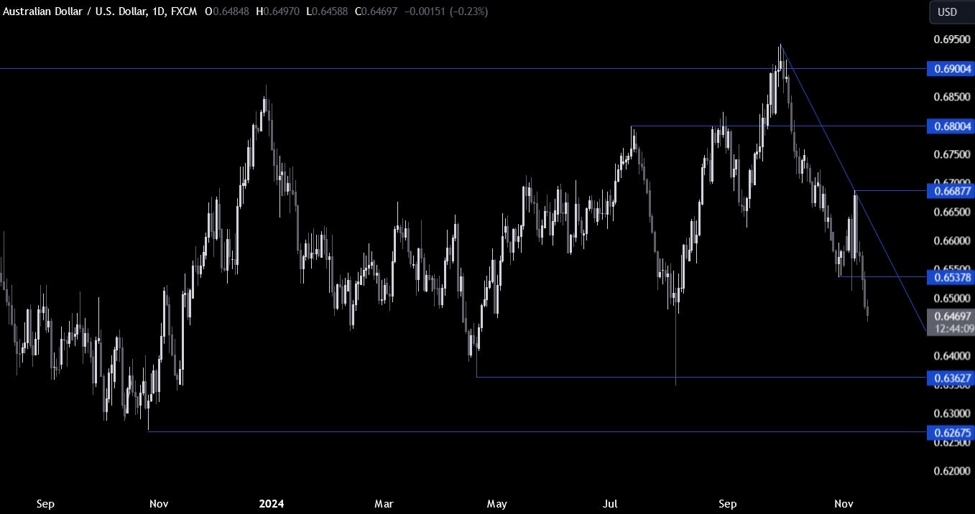

AUDUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that AUDUSD broke through the recent low around the 0.6537 level and

extended the drop into the 0.6460 level as the US Dollar restarted its run on stronger

US data. The natural target should be around the 0.6362 level.

From a risk management

perspective, the sellers will have a better risk to reward setup around the trendline.

The buyers, on the other hand, will want to see the price breaking higher to

start targeting a rally into the top of the yearly range around the 0.69

handle.

AUDUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have another minor downward trendline defining the current bearish momentum.

If we were to get a pullback, the sellers will likely lean on the trendline with

a defined risk above it to position for a drop into new lows. The buyers, on

the other hand, will want to see the price breaking higher to start targeting a

bigger pullback into the major trendline.

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, there’s

not much more we can add although we can see that we have a minor resistance

zone around the 0.65 handle. If the price gets there, we can expect the sellers

to pile in for move lower, while the buyers will look for a break higher. The

red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US PPI and the US Jobless Claims figures. Tomorrow, we

conclude the week with the US Retail Sales data.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link