Fundamental

Overview

The US Dollar started the

week on the backfoot as the odds of a Harris victory jumped higher leading to a

pullback in the Trump’s trades.

Everything hinges on the US

election now with a red sweep seen as the most bullish scenario for the

greenback, while a blue sweep as the most bearish.

The price action will

likely be choppy until we start to get a better sense of who’s going to win, so

the best strategy would be to wait for the results, because the trend that will

be set will likely last for months anyway.

On the AUD side, the RBA kept the cash rate unchanged today as expected

but lowered growth and inflation forecasts slightly. This is just another

subtle change towards a more dovish stance, although the market’s focus is now

elsewhere.

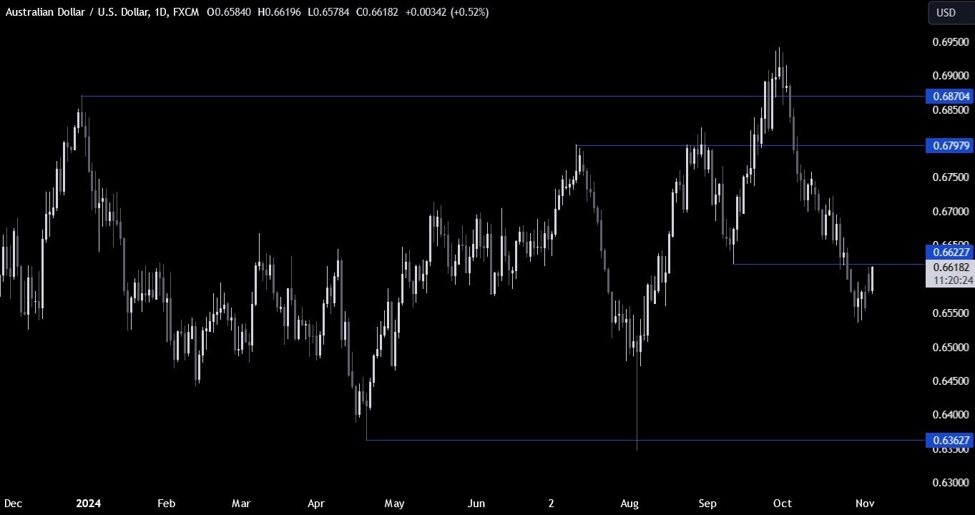

AUDUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that AUDUSD pulled back to the key 0.6622 level amid a weaker US Dollar.

This is where we can expect the sellers to step in with a defined risk above

the level to position for a drop into new lows. The buyers, on the other hand,

will want to see the price breaking higher to increase the bullish bets into

the 0.68 handle.

AUDUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that the price broke above the downward trendline that was defining the bearish

momentum on this timeframe. This might be a signal of a deeper pullback to

follow. There’s not much else we can add here as the sellers will lean on the

0.6722 level to position for new lows, while the buyers will look for a break

higher to target new highs.

AUDUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we now have a minor upward trendline defining the current bullish

momentum on this timeframe. The buyers will likely lean on it to position for

the break of the 0.6722 level, while the sellers will look for a break lower to

increase the bearish bets into new lows. The red lines define the average daily range for today.

Upcoming

Catalysts

Today is the US Presidential Election Day but we will also get the US ISM

Services PMI report. On Thursday, we have the US Jobless Claims and the FOMC

Policy Decision. On Friday, we conclude the week with the US University of

Michigan Consumer Sentiment report.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link