Bloomberg on Friday wrote about how this is a market that is ‘confounding the pros’ because of mixed macro data.

I’m not sure I disagree. There’s certainly a large portion of market participants that were wrong about US inflation falling (though they were write about it falling globally) but when I step back and look across asset classes, there’s a consistent narrative.

- In late October the Fed pivoted away from rate hikes and that kicked off the rally since.

- Inflation has surprised to the upside, but so has growth, leaving a good economic environment despite the market pricing out six Fed cuts this year.

- Oil has rallied on better growth in the US and improving growth prospects in China but mostly on OPEC+ holding together after a dicey December

- AI is a massive tailwind for tech companies and it’s too soon to judge if the hype exceeds the reality.

- Gold is benefiting from sovereign diversification and Chinese retail bids

- Rising yields have led to broad US dollar outperformance due to stronger US growth and inflation

It certainly has been a market that’s taking it one data point at a time and the volatility has been tough but I don’t see any big mysteries about what’s moved markets in the past six month.

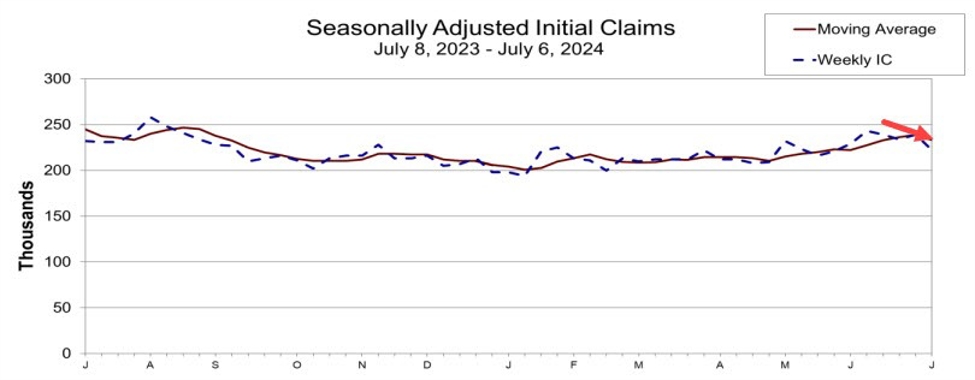

Of course it’s not easy, it never is (though 2021 certainly felt that way). What’s next? It’s still about the Fed here as inflation stays stubbornly strong, particularly in services. There are tentative signs of slowing growth but it’s a big week for economic data with non-farm payrolls and both ISM reports.

This article was written by Adam Button at www.forexlive.com.

Source link