There will be quite a number of key risk events this week but they will mostly be in the days to come. Major central bank meetings are back in the fold, with the RBA, SNB, and BOE all on the agenda. But for today, it will be a slower start to the week with little on the economic calendar.

At most, the Empire State manufacturing index might offer something in US trading. But in Europe, there’s not a whole lot to work with.

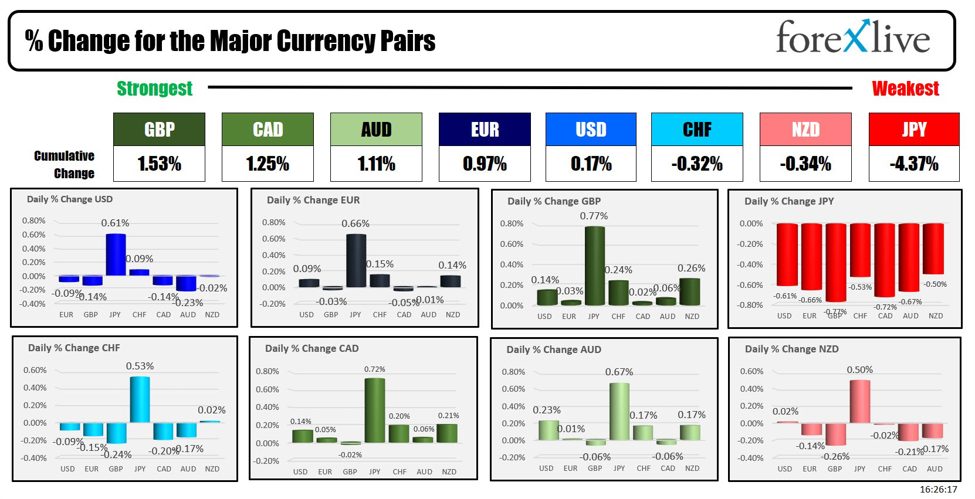

Major currencies are not doing too much, keeping little changed overall. The ranges for the day remain relatively narrow, with the aussie and kiwi mildly weaker.

The softer sentiment from China is one to take note of, with the PBOC continuing to do battle in trying to defend the yuan over the last few weeks. USD/CNY is starting to breach the 7.25 level though, so that might help to keep the dollar underpinned as well.

Looking to the session ahead, there will be a couple of light releases to move things along. But at the balance, we’ll be in for a slower start to the new week.

0800 GMT – SNB total sight deposits w.e. 14 June0800 GMT – Italy May final CPI figures

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

This article was written by Justin Low at www.forexlive.com.

Source link